When you’lso are willing to start options trading, initiate quick—you can is actually a lot more competitive alternatives actions later on. To start with, it’s far better work with a secured item you realize better and choice an amount your’lso are safe losing. Options change doesn’t make sense for all—specifically people that favor a give-from investing means. You can find basically about three choices you have to make that have possibilities change (assistance, rates and you can date), and therefore adds much more difficulty to your using procedure than simply many people prefer. As a result, possibilities change will be a payment-effective way and then make a great speculative bet with smaller exposure when you are offering the prospect of higher output and you may a more strategic means to help you using.

- The brand new Motley Deceive are at millions of people per month thanks to our very own premium spending possibilities, totally free information and you may industry analysis to your Deceive.com, top-rated podcasts, and you can low-funds The newest Motley Deceive Foundation.

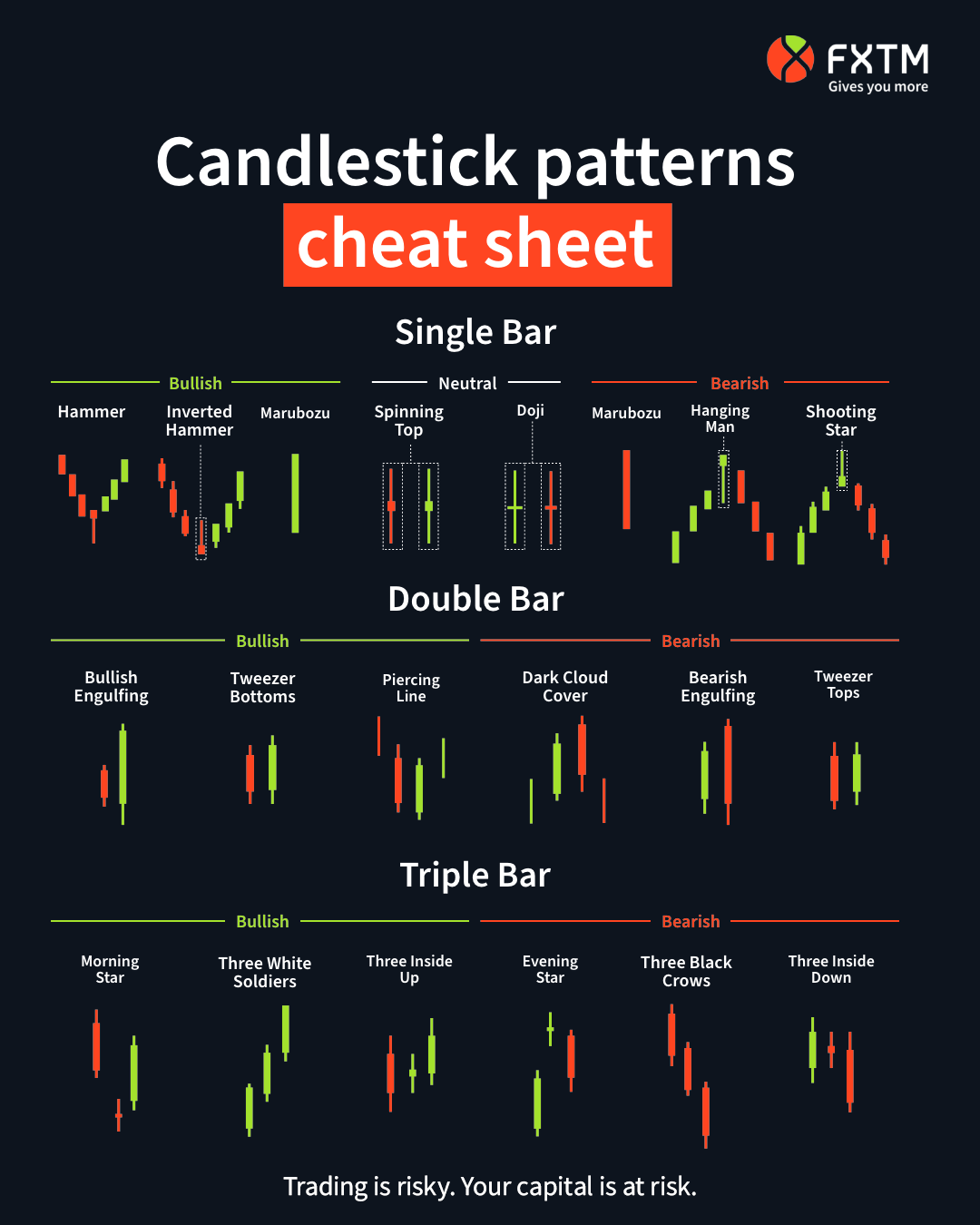

- Unlike carries, choices convey more moving bits — struck prices, day decay, volatility.

- Delight assess your investment expectations, exposure tolerance, and you will economic issues to decide whether margin is suitable for your requirements.

- Like all investment alternatives you will be making, you will have a very clear notion of that which you aspire to to do before exchange alternatives.

- A lengthy straddle are only able to remove all in all, everything you taken care of they.

Alternatives Trading Informed me: An amateur’s Book

One which just realize choices exchange, believe the way it aligns together with your full requirements and you can exposure threshold, or take care and attention to understand around you can just before your dive to the that it state-of-the-art spending technique. Brokerages often have some other levels of alternatives trading approval considering your own experience and you may financial predicament. Performing options exchange needs trying to find a professional representative and training with virtual money ahead of risking real investment. Don’t worry – to your right education and practice, you’ll understand how to use these flexible money devices effectively.

Exactly what are the main risks of options change?

Whenever a trader speculates, he could be and make a gamble the fundamental resource within the a great offered choice goes right up inside worth. An investor can use speculation in order to reap money, leveraging its underlying shares in the even more worthwhile investment. Performing and you can promoting options is additionally described as “writing” the choices. As with any other funding method, possibilities trade has its own listings away from possible advantages and you can risks, and it’s crucial that you discover them to try to avoid and make expensive mistakes. Such as, state you buy a visit option for 100 shares from ABC stock which have a paid away from $3 per display, however, you’re dreaming about an amount boost this time.

Therefore, they https://connectimmobilien.com/ don’t have to purchase the investment in the event the their rate goes in the alternative advice. For this reason, a safeguarded name restrictions losses and you will growth since the restrict money is limited on the number of premiums collected. If the inventory goes into the alternative rates guidance (i.age., its price goes down instead of right up), then alternatives expire meaningless plus the buyer will lose just $2 hundred. Much time calls are useful methods for traders if they are reasonably certain that certain inventory’s speed increases. Not only are you obliged to pay a paid when selecting alternatives, nevertheless will also have to invest a fee to your representative and quick regulatory charge. For this reason, they helps make sense to consider almost certainly will cost you facing prospective earnings and loss, before purchasing a choice offer.

Where to start trading alternatives

What if, instead of a property, their investment is actually an inventory otherwise directory financing? Similarly, in the event the an investor wishes insurance policies to their S&P 500 directory collection, they are able to get put possibilities. According to the Cboe, along side long term, more seven inside ten solution contracts is actually closed-out ahead of expiring, on the some other a couple in the ten end instead well worth, and from the one in 20 rating resolved. Should your choice is on the money, you can even want to intimate it before the expiry to increase profit. Or you aren’t within the profit you can log off your position accessible to expiry, and, if this does not transfer to money, only get rid of the purchase price your repaid to open up.

Offering choices agreements might be an important part of forget the strategy. As opposed to conventional trading, choices give book opportunities. It make it investors when planning on taking advantageous asset of market motions instead totally committing to the root advantage. They’re prospect of high efficiency, chance management, and you can income age group due to superior collection.

If the silver increases over the struck cost of $step one,760 through to the option expires, they shall be able to pick gold at a discount. If the silver stays below $1,760, the brand new buyer doesn’t must do it the choice and can just give it time to end. Within this scenario, the fresh trader do remove the new premium repaid to buy the phone call choice. If your stock really does go above the fresh strike price, your choice is in the money. That means you could potentially exercise they to possess an income, or sell to another options buyer for a return.